Explore the ScaleUp Annual Review 2023

Select a section to expand and explore this year's review..

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Scaleup Survey 2023

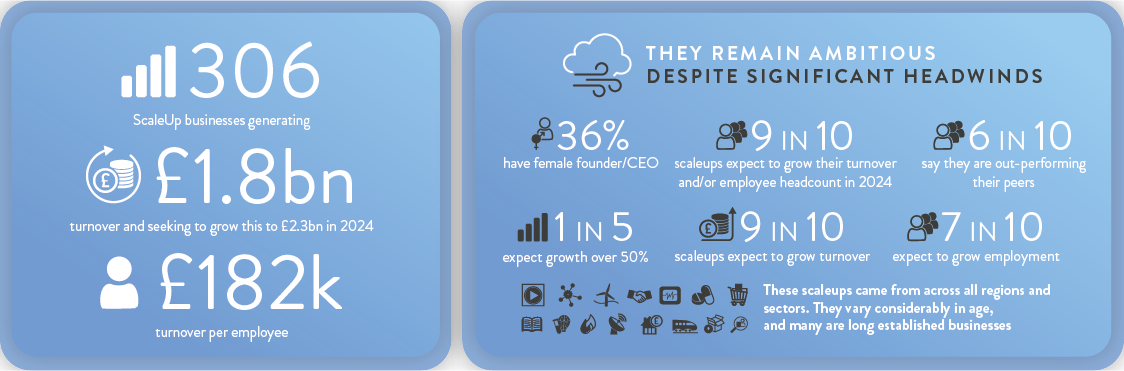

This report focuses on the views of 306 scaleup leaders. Scaleups are a key engine for growth in the UK economy: the scaleups in our survey generated on average £182k of revenue per employee.

Despite ongoing macroeconomic challenges affecting the wider business landscape in the UK and beyond, UK scaleups remain ambitious for growth.

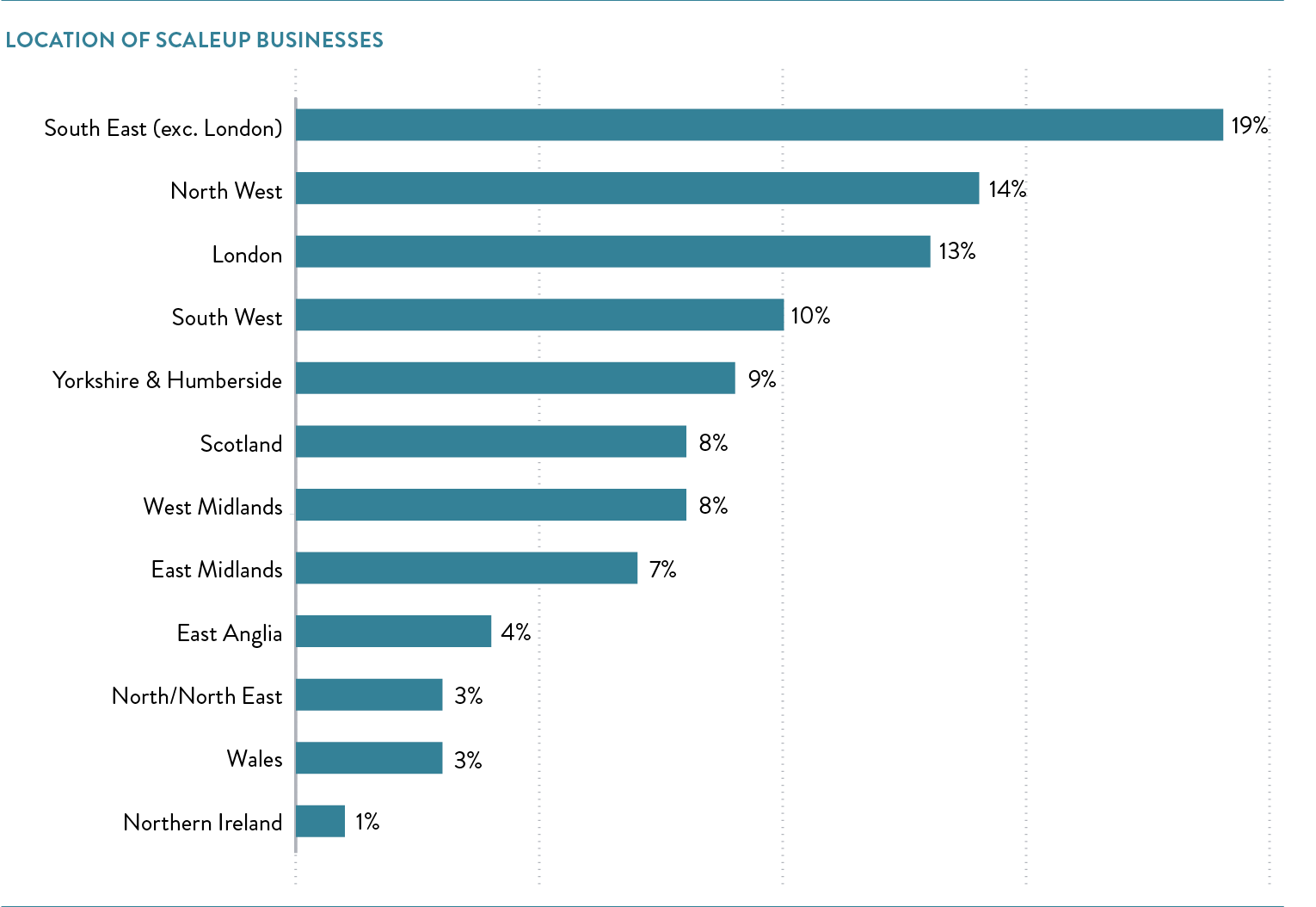

Scaleups are found across the UK

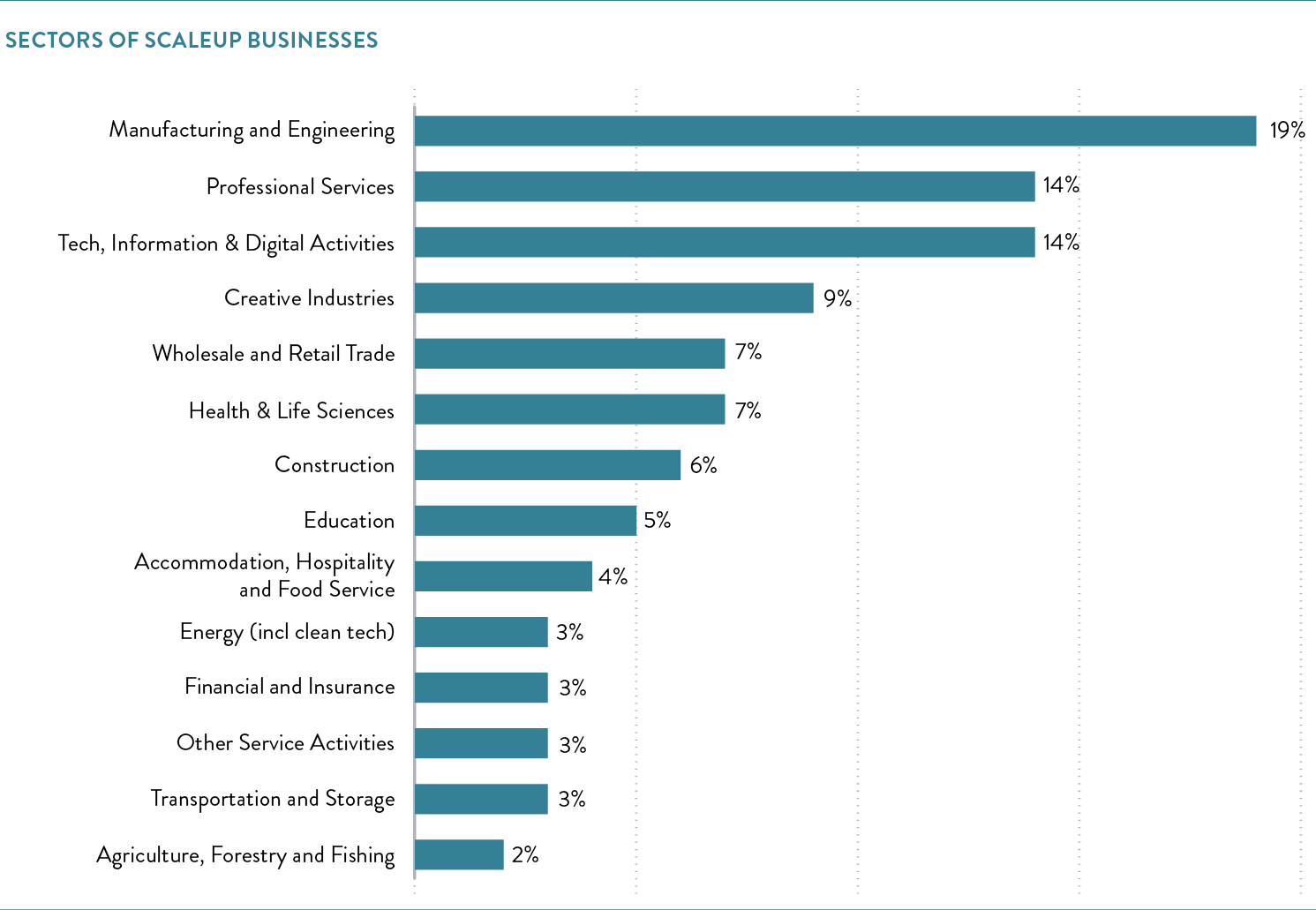

Scaleups Operate in Every Sector

Scaleups cover the entire economy in diverse sectors from Professional Services to Tech, Information & Digital Activities and from Advanced Manufacturing & Engineering to the life sciences, wholesale/retail and the creative industries. They are helping to meet ongoing challenges to society – 4 in 10 scaleups reported operating in the green economy (35%), and 3 in 10 considered themselves a social business (30%), with 31% considering themselves ESG compliant (Environmental, Social and Governance). Overall, 6 in 10 scaleups (56%) felt they met at least one of these criteria.

They are helping to meet ongoing challenges to society – 4 in 10 scaleups reported operating in the green economy (35%), and 3 in 10 considered themselves a social business (30%), with 31% considering themselves ESG compliant (Environmental, Social and Governance). Overall, 6 in 10 scaleups (56%) felt they met at least one of these criteria.

When it comes to ESG compliance, half of scaleups say they are facing challenges with 1 in 3 stating that understanding and complying with reporting requirements are barriers as well as ways in which they can measure effectiveness of their activities; they are also cautious about the lack of alignment between different parties resulting in duplication of work when reporting. 1 in 5 are facing costs to upgrade equipment and processes, as well as issues around ensuring compliance in their supply chains.

Scaleups are well established and can be sizeable businesses

- 65% of scaleups have been trading for ten years or more

- 1 in 10 in this cohort of CEOs have a turnover in excess of £10 million

- 41% have 20+ employees, with 18% have over 50 employees and 6% having 100 or more.

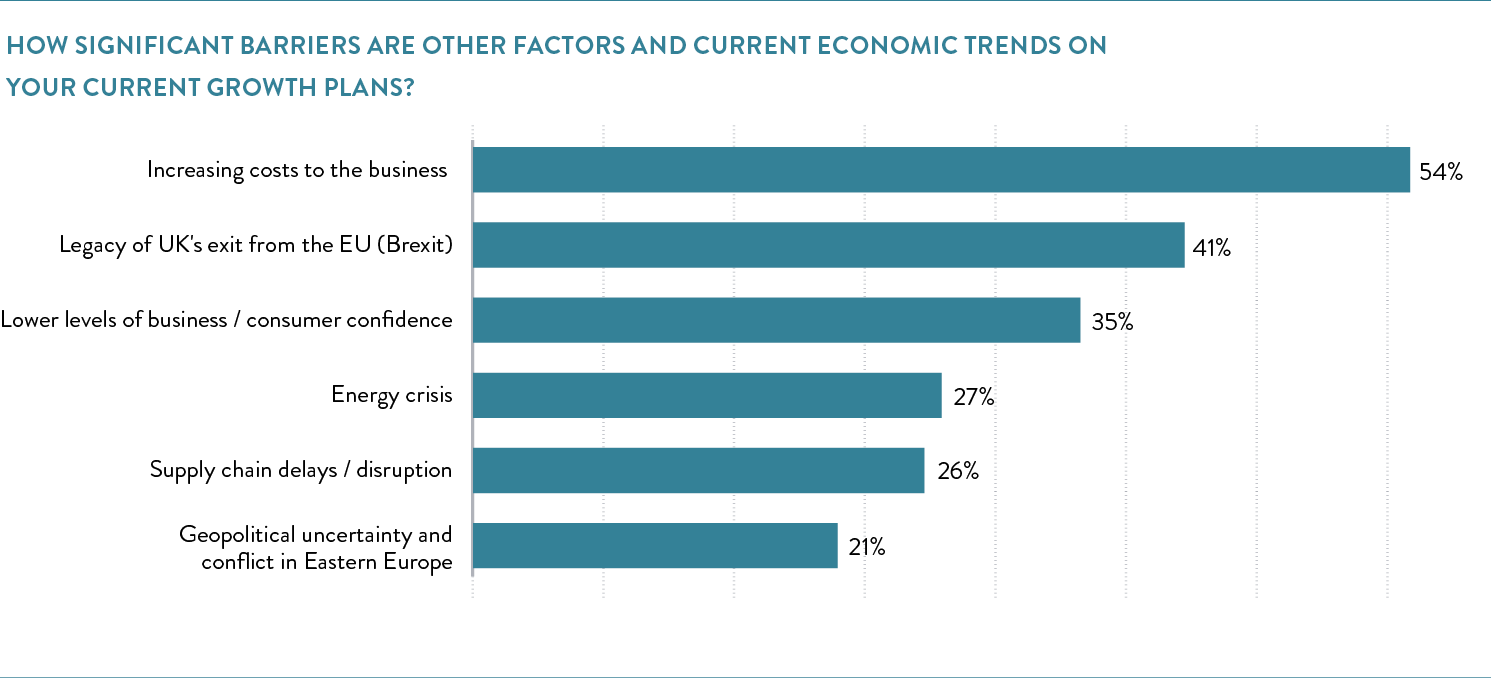

THERE ARE HEADWINDS BUT SCALEUPS ARE FOCUSED ON THE FUTURE

The resilience of scaleups in the face of increased uncertainty in the business environment is borne out through their growth expectations and perception that they continue to outperform their peers. However they continue to be concerned about increasing costs alongside ongoing effects of Brexit. other concerns around the energy crisis and lower consumer confidence.

Challenges around consumer confidence, energy, supply chains and geopolitical uncertainty also play on the minds of our scaleup leaders and their growth plans.  These macro trends are affecting scaleups in different sectors in different ways, with those in construction and lifesciences significantly more concerned about increasing costs to business (74% and 65% respectively). Those in manufacturing & engineering and consumer trades are much more concerned about the ongoing legacy of the UK’s departure from the EU (both 51%). Manufacturers are also more concerned about supply chain issues (47%). Conversely those operating in tech & digital and professional services are less concerned about macro factors than their peers.

These macro trends are affecting scaleups in different sectors in different ways, with those in construction and lifesciences significantly more concerned about increasing costs to business (74% and 65% respectively). Those in manufacturing & engineering and consumer trades are much more concerned about the ongoing legacy of the UK’s departure from the EU (both 51%). Manufacturers are also more concerned about supply chain issues (47%). Conversely those operating in tech & digital and professional services are less concerned about macro factors than their peers.

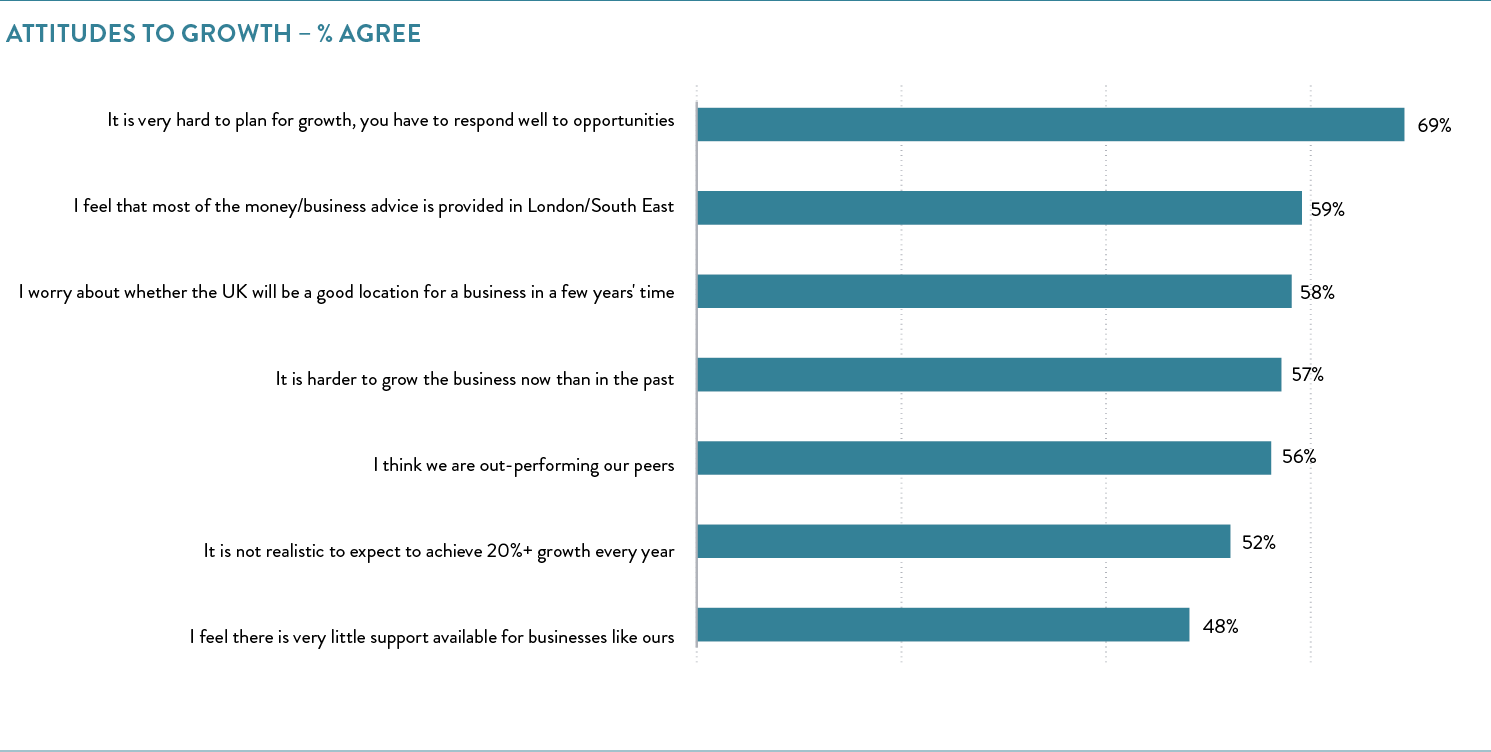

Leaders’ confidence around the economic outlook continues to be challenging. The concern about whether the UK will be a good location for a business in a few years’ time has increased to 58% since last year, up from 50% in 2022. A similar proportion of scaleup leaders (57%) perceive that it is harder to grow the business now than in the past, similar to levels seen in 2022 however this maintains the significant increase from 41% reported in 2021. There remains a continuing perception that there is very little support available for businesses like theirs, reported by 5 in 10 leaders.

Despite this, 6 in 10 agree that they are out-performing their peers and 5 in 10 continue to think that it is realistic to expect 20%+ growth each year.

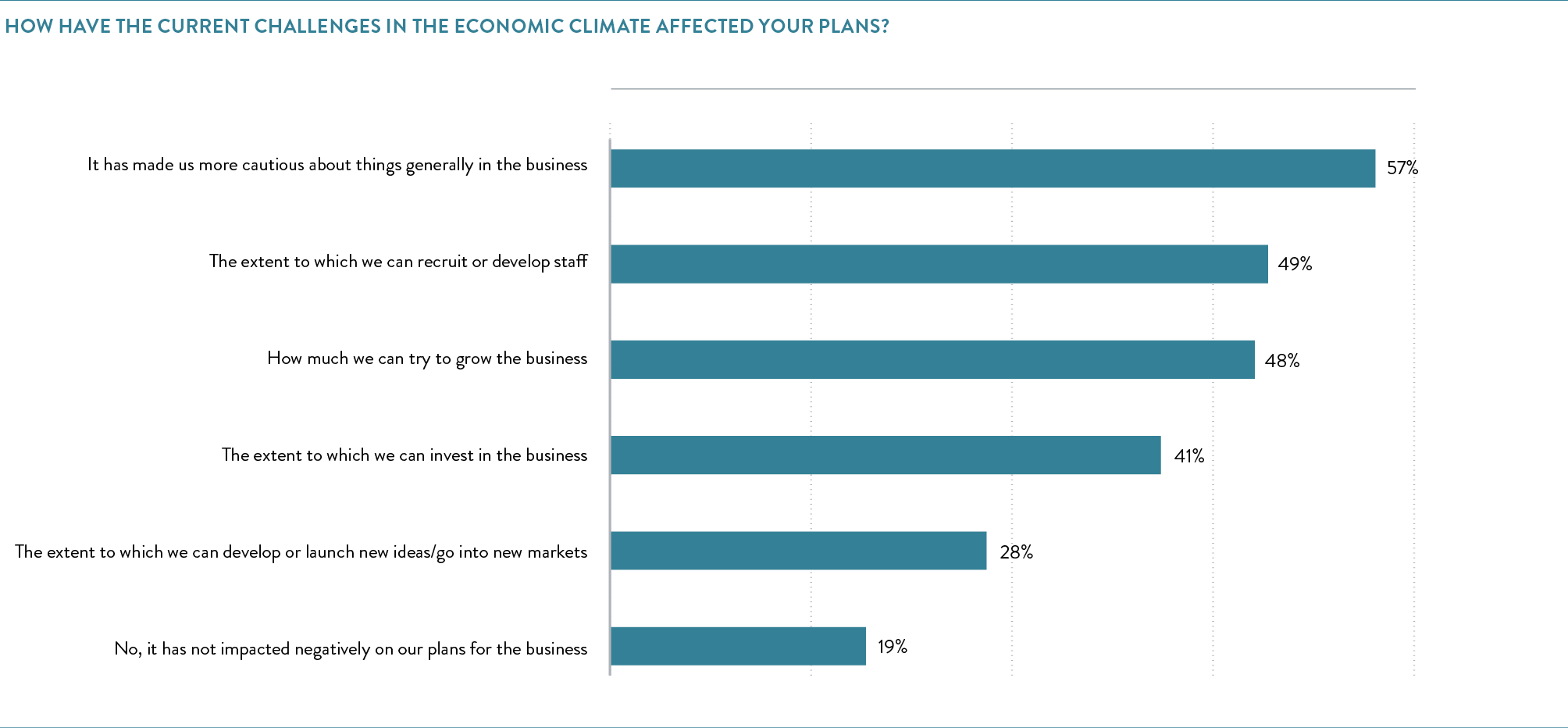

8 in 10 Scaling business leaders report that these ongoing economic challenges are having a negative impact on their plans for the business, with most generally more cautious (57%). More specifically though 5 in 10 report concerns around recruitment and growth, while 4 in 10 are concerned about making investment decisions.

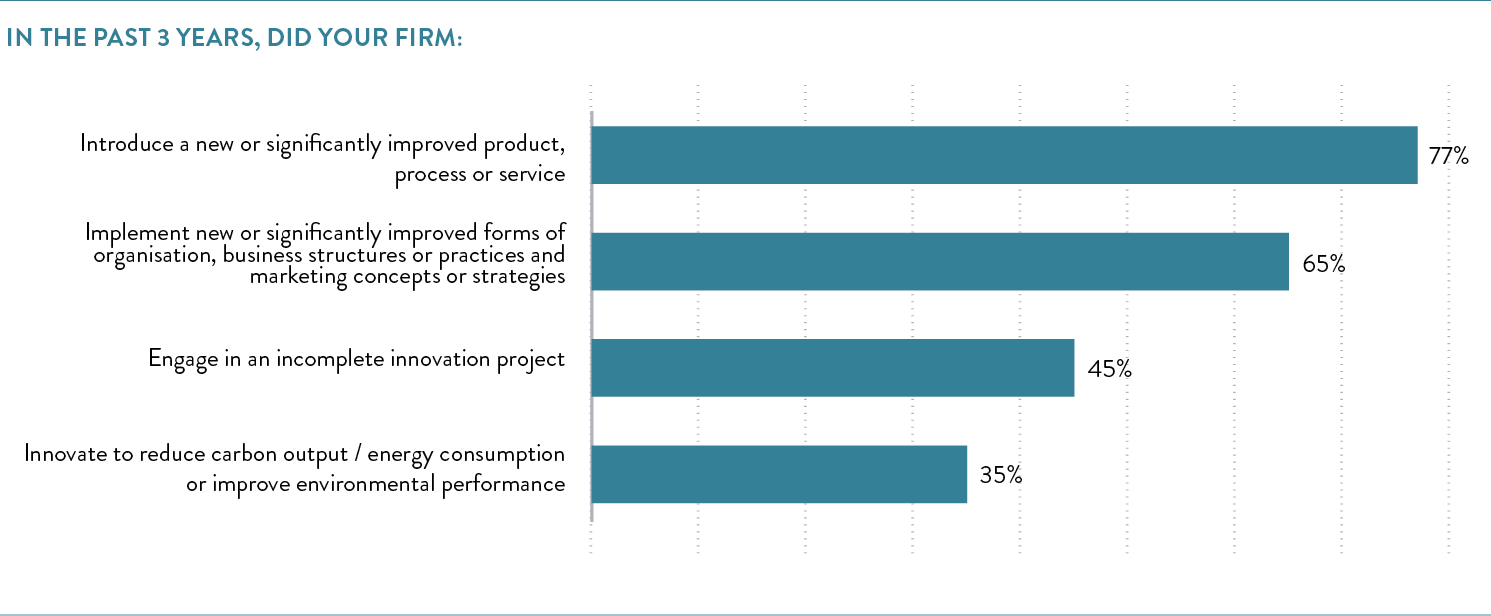

To support current and enable future growth, scaleups continue to innovate, pivot and adopt new technologies and working practices. 8 in 10 introduced a new or significantly improved product, process or service and over 7 in 10 implemented a new or significantly improved business structure in 2022. Two fifths of the scaleups responding to the survey have also innovated specifically to reduce their energy consumption or improve their environmental performance. While 54% have formed collaborations and partnerships with universities, corporates or public sector to develop a new product or service.

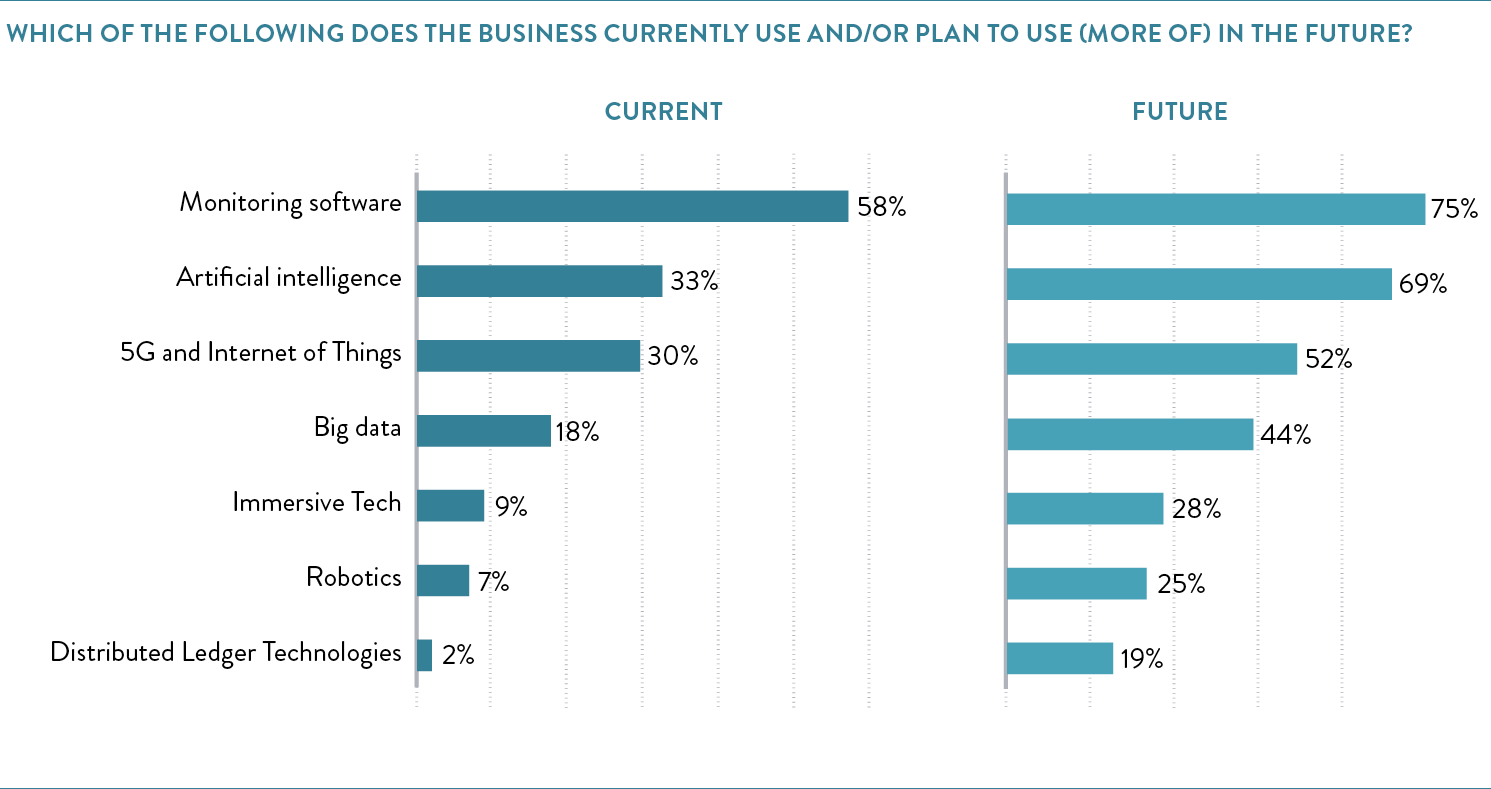

Scaleups are at the forefront of new technologies with 6 in 10 currently using software to monitor performance and productivity. 3 in 10 use 5G and the Internet of Things and 2 in 10 are utilising Big Data. They expect to amplify their use of advanced technologies, especially Immersive Tech and Robotics. Following trends seen across all businesses, with the emergence of generative AI platforms such as ChatGPT, Bard and LLaMa 2 the use of AI has doubled since 2022, with 1 in 3 scaleups leveraging this technology and significantly 7 in 10 planning to use it in the future.

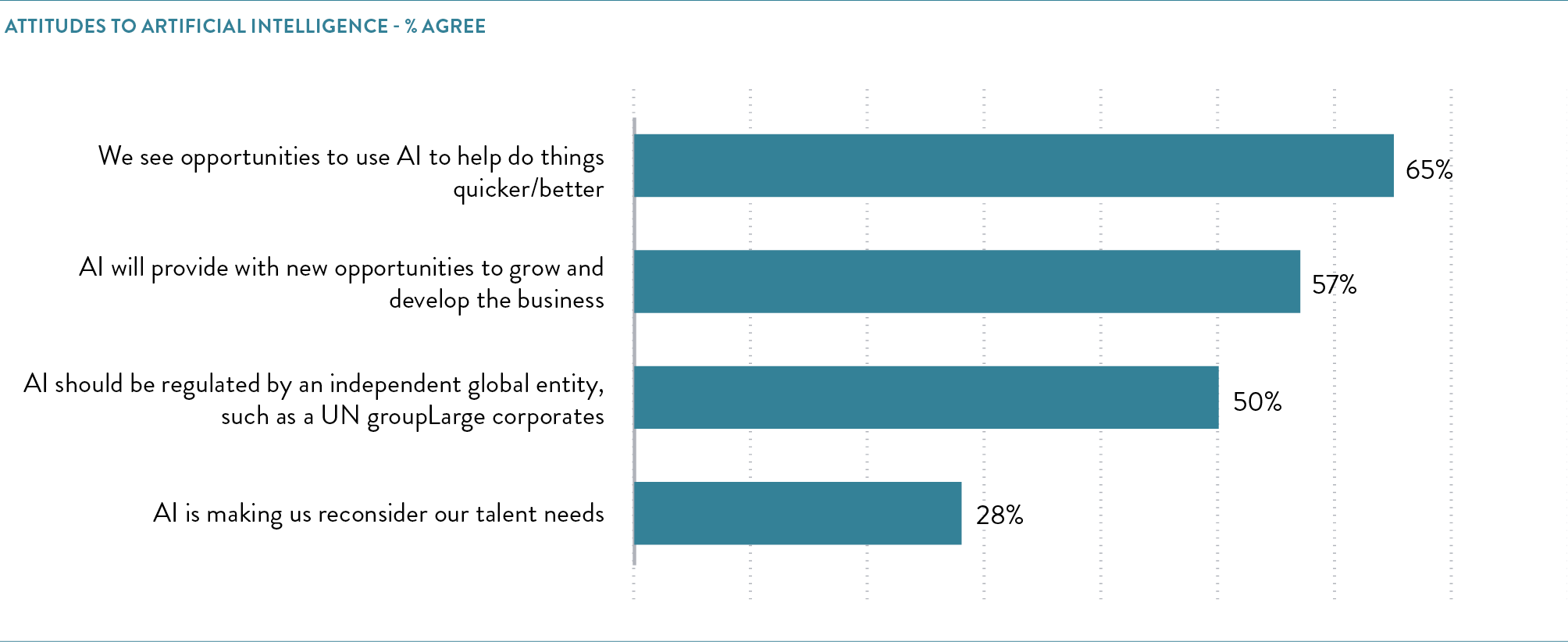

Many scaling business leaders see AI as a way to do things better and more quickly (7 in 10), and 6 in 10 see opportunities for business growth. For 1 in 3 though AI is making them reconsider their workforce and talent needs.

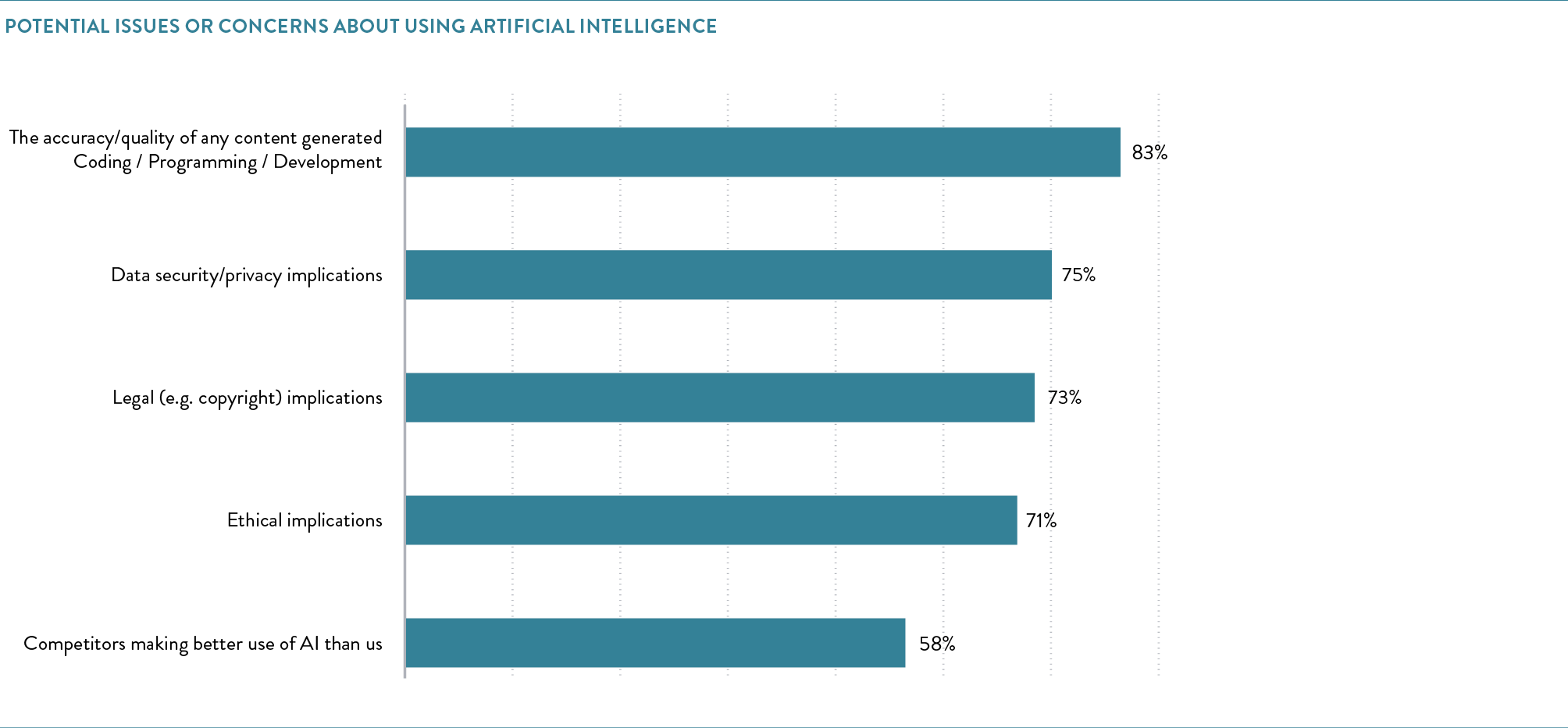

Concerns remain about the validity and accuracy of generative AI technologies with 8 in 10 stating this as well as data security and privacy implications. 7 in 10 are considering the wider legal (e.g copyright) and ethical implications.

Importantly, 5 in 10 scaleup leaders consider that AI should be regulated by an independent global entity, such as a UN group.

To support in their growth journey scaleups are seeking effective relationship management and want to be recognised and ‘put on the map’

Having a single point of contact to act as a relationship manager and help businesses navigate support from government and the private sector is increasingly important to scaleups with 73% seeking this type of arrangement in 2023, up marginally from 70% last year.

When it comes to recognition, 68% of scaleup feel that having a kitemark which identifies them as a scaleup would be beneficial. With 6 in 10 seeking to be identified by players in the private sector and a similar proportion wanting the government to share their scaleup status internally with other departments and agencies. 8 in 10 would be happy for their scaleup status to be shared on public record, with 6 in 10 stating this should be on an opt-in basis.

When ranking their top 3 barriers to growth once again Access to Markets is seen by most scaleups as their biggest challenge (64%). This is closely followed by Access to Talent (58%), when choosing the single greatest barrier to growth however Talent (29%) and Markets (28%) are on par.

Access to Growth Capital is reported as a challenge by 38%, with 32% citing Leadership Development and 32% mentioning access to Infrastructure and R&D Support.

CONTENTS

Introduction 2023

Chapter 1 2023

The ScaleUp Business Landscape

Chapter 2 2023

Chapter 3 2023

Share